Is your brand meeting consumer expectations during the cost-of-living crisis?

By Steve Brockway Maru/Matchbox | November 2022

We spoke to 1,000 nationally representative UK consumers to better understand how companies and brands can best respond and connect with consumers in times of financial stress.

The cost-of-living crisis is impacting many people as prices rise ahead of income.

While the UK has weathered previous economic challenges, a combination of global and political turmoil and unprecedented economic uncertainty presents unique challenges to companies and brands looking to navigate this turbulence.

This proposed how brands can connect with customers in a way that validates their uncertainty and supports them through this challenging time.

The challenges for brands

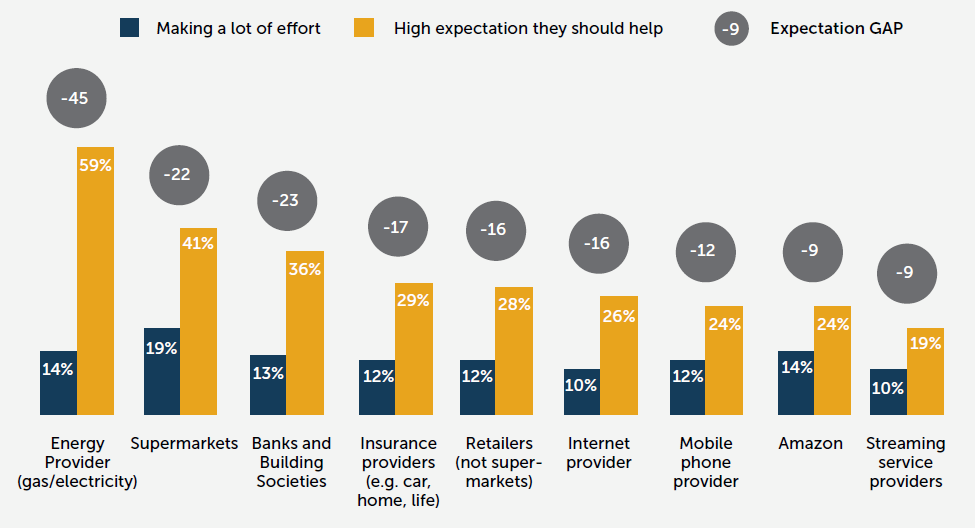

Our research indicates an expectation 'gap' between how brands and companies are perceived to be helping people and what people expect. We found this is an opportunity for individual brands to stand up and be counted on when consumers need it most.

In times of financial hardship, consumers are seeking proactive advice on saving and how to engage with their desired brands at the optimum price. Brands that fail to provide simple, transparent pricing and access to their entry price point options will be perceived as inaccessible and out of touch.

A final challenge for brands to overcome is the current perception of, at best, being perceived impersonal and, at worst indifferent to people’s needs. People are giving permission to brands to reach out and offer support.

To genuinely connect with consumers in the marketplace, brands need to provide a feeling of reassurance that shows they understand but is also accessible and enables action.

What is the Expectation Gap

We asked how much expectation people had of each sector helping them and compared the results to current perceptions. Which sectors are perceived as doing the most for consumers? This comparison enables us to examine the 'gap' between expectation and actual performance for each sector, revealing who has more opportunity.

Despite energy companies having the 2nd highest (14%) of people saying they were 'Making a lot of effort,' we observed the most significant gap (45 points) between actual and expectations of helping consumers. The insight is clear that utilities need to step up and act or continue to be cast as the villain.

Banks and building societies had the 2nd highest overall gap (23 points) between actual expectations and helping consumers. And supermarkets followed closely behind with a (22 points) gap between expected help and making an effort.

Industries with the smallest gap between perceived and expected help include Amazon and streaming, service providers. Amazon tied for 2nd place for "making a lot of effort."

Our research indicated that some industries have high expectations, whereas others have lower expectations regarding perceived and expected help. However, all industries observed an expectation gap. This leads to the question, what can brands do to help close the gap?

Building a connection

We then focused on brands that people make regular payments or subscriptions to; we asked participants to undertake a choice-based exercise where they selected the most appealing actions.

The top-rated action overall was when people were offered the 'Lowest price option' for their product or service, indicating the need for price transparency.

The action that was ranked in 2nd place indicates a need from consumers for communication explaining why prices are increasing for their products and services, demonstrating the context of any price rise along with how this enables investments in products or services is vital and will drive how consumers feel about its perceived fairness.

Lastly, consumers found the idea of 'Flexible payment options' far more appealing than 'Delaying or deferring' or 'Pay as you go' payments indicating consumers want continuity but with flexibility baked into their regular payments or subscriptions.

Read our whitepaper to learn more about three key takeaways for brands to make more meaningful connections during the cost-of-living crises.

Download the whitepaper

Cost of living crisis How can brands connect?

New insights that enables your brand to make meaningful connections in times of crisis